updated ( new request)

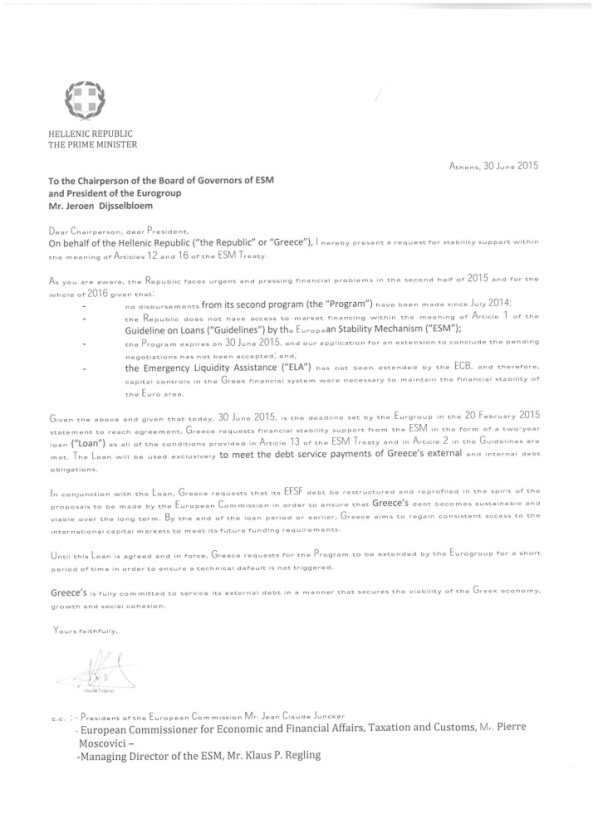

The Greek prime minister made the request Tuesday in a letter to the Eurogroup president.

.

By MATTHEW KAMINSKI AND FLORIAN EDER 30/6/15, 3:54 PM CET Updated 30/6/15, 4:43 PM CET

In a last-hour move to avoid default later this evening, Greece’s Prime Minister Alexis Tsipras asked the eurozone’s rescue fund for a two-year loan to cover the country’s coming debt obligations.

The Greek request was made in a letter, obtained by POLITICO, to Eurogroup president Jeroen Dijsselbloem in his capacity as chairman of the board of governors of the European Stability Mechanism on Tuesday.

Dijsselbloem responded in a tweet that the Eurogroup would hold an “extraordinary” conference call at 7 p.m. to consider the request.

In addition to a loan from the ESM, Tsipras asked the Eurogroup to extend the country’s bailout program, which expires at midnight Tuesday, “for a short period of time in order to ensure a technical default is not triggered.”

The Greek leader also asked that the country’s existing debt be restructured.

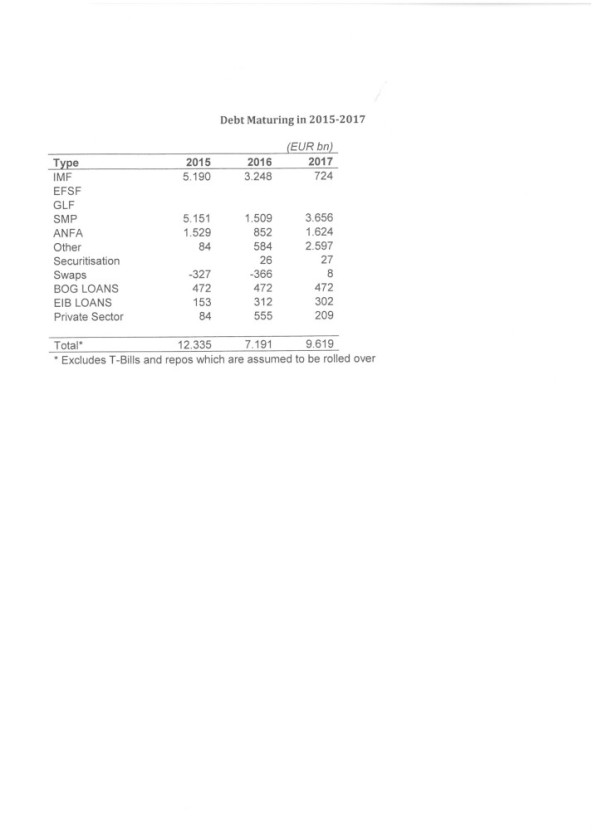

While Tsipras didn’t specify how large the loan should be in the letter, it includes a spreadsheet of Greek debt coming due in the next two years. By the end of 2017, Greece has to make payments of some €26 bn, according to the document. Tsipras’ letter states, in line with ESM’s rules, that the loan would be used “exclusively to meet the debt service”.

After that two-year loan period, the prime minster said Greece expected to be able to return to international capital markets to meet its funding needs.

European leaders were considering the proposal on Tuesday afternoon, but officials noted that an ESM would come with economic reform conditions that Greece had rejected before.

The official letter of the Greek government, June 30, 2015 (POLITICO):

http://www.politico.eu/article/greece-default-debt-eu-tsipras-asks-for-fresh-money/

ΜΕΤΑΦΡΑΣΗ ΤΗΣ ΕΠΙΣΤΟΛΗΣ ΤΣΙΠΡΑ ΠΡΟΣ ESM:

«Αγαπητοί πρόεδροι,

Εκ μέρους της Ελληνικής Δημοκρατίας, σας παρουσιάζω μία πρόταση για στήριξη με βάσει τα άρθρα 12 και 16 του κανονισμού του ESM.

Όπως γνωρίζετε η χώρα αντιμετώπισε ισχυρές πιέσεις στο β’ εξάμηνο του 2015 και (θα αντιμετωπίσει) για το σύνολο του 2016, με δεδομένο ότι:

– δεν υπήρξαν εκταμιεύσεις κεφαλαίων από το δεύτερο πρόγραμμα στήριξης από τον Ιούλιο του 2014

-η χώρα δεν έχει πρόσβαση σε χρηματοδότηση από τις αγορές, όπως υποδεικνύεται στο Άρθρο 1 της «Οδηγίας προς δανεισμό» του ESM

-το πρόγραμμα ολοκληρώνεται στις 30 Ιουνίου 2015 και το αίτημά μας για παράταση του προγράμματος δεν έγινε δεκτό

– Ο ELA δεν αυξήθηκε από την ΕΚΤ και ως εκ τούτου η επιβολή capital controls ήταν επιβεβλημένη, προκειμένου να διατηρηθεί η χρηματοοικονομική σταθερότητα στην Ευρωζώνης.

Δεδομένων των παραπάνω και ότι σήμερα, 30 Ιουνίου 2015, είναι το deadline βάσει της απόφασης του Eurogroup της 20ής Φεβρουαρίου 2015, η Ελλάδα ζητά οικονομική στήριξη από τον ESM υπό τη μορφή μία διετούς δανειακής συμφωνίας, και βάσει των συνθηκών που ισχύουν σύμφωνα με το Άρθρο 13 του ESM και των όρων στο Άρθρο 2.

Το δάνειο θα χρησιμοποιηθεί αποκλειστικά για την αποπληρωμή του χρέους της Ελλάδας είτε προς το εξωτερικό είτε προς το εσωτερικό.

Σε συνδυασμό με το δάνειο, η Ελλάδα ζητά την αναδιάρθρωση των χρεών της στον EFSF βάσει των προτάσεων που έγιναν από την Κομισιόν και προκειμένου να διασφαλιστεί ότι το ελληνικό χρέος θα καταστεί βιώσιμο σε μακροπρόθεσμο ορίζοντα.

Μέχρι το πέρας του δανείου ή νωρίτερα η Ελλάδα έχει στόχο να κερδίσει εκ νέου την πρόσβαση προς τις διεθνείς αγορές, ούτως ώστε να καλύψει τις μελλοντικές χρηματοδοτικές της ανάγκες.

Έως ότου αυτό το δάνειο συμφωνηθεί, η Ελλάδα ζητά από το Eurogroup την παράταση για ένα μικρό διάστημα του υπάρχοντος προγράμματος, ούτως ώστε να μην υπάρξει τεχνική χρεοκοπία της χώρας.

Η Ελλάδα δεσμεύεται πλήρως να εξυπηρετήσει το εξωτερικό της χρέος με τέτοιο τρόπο, ώστε να διασφαλίζεται η βιωσιμότητα της ελληνικής οικονομίας, η ανάπτυξή της αλλά και η κοινωνική συνοχή».

ΕΠΙΣΤΟΛΗ ΤΣΙΠΡΑ προς τον πρόεδρο της Κομισιόν, τον πρόεδρο της Ευρωπαϊκής Κεντρικής Τράπεζας και τηνδιεθύνουσα σύμβουλο του ΔΝΤ

H επιστολή μεταφρασμένη στα Ελληνικά

Προς τον πρόεδρο της Κομισιόν

Ζαν Κλοντ Γιούνκερ

Προς τον πρόεδρο της Ευρωπαϊκής Κεντρικής Τράπεζας

Μάριο Ντράγκι

Προς την διεθύνουσα σύμβουλο του ΔΝΤ

Κριστίν Λαγκάρντ

Σας γράφω για να σας ενημερώσω για τη θέση της Ελληνικής Δημοκρατίας όσον αφορά τη λίστα των Prior Actions (προαπαιτουμένων) της Staff Level Agreement όπως αυτή δημοσιεύθηκε στην ιστοσελίδα της Ευρωπαϊκής Επιτροπής στις 28 Ιουνίου 2015.

Η Ελληνική Δημοκρατία είναι έτοιμη να δεχθεί αυτή το staff-level agreement (τεχνική συμφωνία σε επίπεδο εμπειρογνωμόνων) που υπόκειται στις ακόλουθες τροποποιήσεις, προσθήκες ή επεξηγήσεις, ως ένα τμήμα της επέκτασης του εκπνέοντος προγράμματος διάσωσης EFSF και της νέας δανειακής συμφωνίας για την οποία εστάλη αίτημα σήμερα, Τρίτη 30 Ιουνιου 2015

Όπως θα παρατηρήσετε οι προσθήκες μας είναι συγκεκριμένες και σέβονται απολύτως την ευρωστία και την αξιοπιστία του σχεδιασμού του συνολικού προγράμματος.

ΦΠΑ

Να διατηρηθεί η έκπτωση του 30% στα νησιά επί των νέων συντελεστών που θα εφαρμοστούν

Δομικά δημοσιονομικά μέτρα

Σταδιακή αύξηση της προκαταβολής πληρωμής του ατομικού φόρου στο 100% και τη σταδιακή κατάργηση της ειδικής φορολογικής μεταχείρισης των αγροτών (περιλαμβανομένης της επιδότησης στο πετρέλαιο κίνησης) μέχρι το τέλος του 2017.

Περιορισμό των αμυντικών δαπανών στα 200 εκατ. ευρώ γα το 2016 και στα 400 εκατ. ευρώ για το 2017 μέσα από μια συγκεκριμένη ομάδα ενεργειών, περιλαμβανομένων της μείωσης του αριθμού του προσωπικού και προμηθειών.

Συντάξεις

Θα εφαρμοστεί πλήρως η μεταρρύθμιση του 2010 αλλά η εφαρμογή της μεταρρύθμισης του 2012 (ρήτρα μηδενικού ελλείμματος) να αναβληθεί μέχρι να εφαρμοστεί η νέα νομοθετική μεταρρύθμιση έως τον Οκτώβριο 2015

Σταδιακή κατάργηση του ΕΚΑΣ έως το τέλος του 2019 αλλά χωρίς άμεση εφαρμογή για το 20% των δικαιούχων

Όλα τα έξοδα θα καταργηθούν σταδιακά έως το τέλος του 2017 αρχής γενομένης της 31ης Οκτωβρίου 2015.

Εργασιακά

Το νέο εργασιακό πλαίσιο θα νομοθετηθεί μέχρι το φθινόπωρο του 2015

Αγορές προϊόντων

Άμεση εφαρμογή συγκεκριμένων συστάσεων από τον ΟΟΣΑ τουριστικές ενοικιάσεις, τουριστικά λεωφορεία, άδειες φορτηγών, κώδικα δεοντολογίας για τα παραδοσιακά τρόφιμα και τους ευρωπαϊκούς κώδικες για τα οικοδομικά υλικά, απελευθέρωση επαγγελμάτων συμβολαιογράφων, αναλογιστών, και δικαστικών επιμελητών, η απελευθέρωση της αγοράς των γυμναστηρίων και η εξάλειψη ενός σημαντικού ποσοστού ενοχλητικών χρεώσεων.

Επιπροσθέτως, σε συνεργασία με τον ΟΟΣΑ, εφαρμογή ενός γενναίου προγράμματος μεταρρυθμίσεων συμπεριλαμβανομένων:

– Δημιουργία υπηρεσιών Οne-Stop-Shop (OSS) για επιχειρήσεις (ανάλυση των βέλτιστων πρακτικών καθώς και έναν ολοκληρωμένο χάρτης πορείας ο οποίος έχει ήδη δημιουργηθεί και ολοκληρωθεί με τη βοήθεια του ΟΟΣΑ).

-Την άμεση διεξαγωγή μίας συνολικής αξιολόγησης του ανταγωνισμού σε συγκεκριμένους τομείς οι οποίοι χαρακτηρίζονται από ολιγοπωλιακές πρακτικές (π.χ. κατασκευές, χονδρικό εμπόριο, γεωργικά προϊόντα, μέσα ενημέρωσης κ.λ.π.) και υιοθέτηση των συστάσεων αναλόγως.

-Εφαρμογή μίας ολοκληρωμένης στρατηγικής ενάντια στις διεφθαρμένες επιχειρήσεις και στις πρακτικές τους, για παράδειγμα στο χώρο της σύναψης δημοσίων συμβάσεων (το πρόγραμμα έχει ήδη προετοιμαστεί από τον ΟΟΣΑ).

Ο ΑΔΜΗΕ θα χωριστεί από τη ΔΕΗ σε ξεχωριστή νομική οντότητα υπό πλειοψηφική κρατική κυριότητα.

Σας ευχαριστώ εκ των προτέρων για την υποστήριξή σας.

Αλέξης Τσίπρας

update

Aίτημα για … 3ετές δάνειο από τον ESM

Ο υπουργός Οικονομικών Ευκλείδης Τσακαλώτος απέστειλε την κάτωθι επιστολή στον Πρόεδρο και Διευθύνοντα Σύμβουλο του Ευρωπαϊκού Μηχανισμού Σταθερότητας (ESM), με το αίτημα για 3ετή χρηματοδότηση.

Η Ελλάδα θα υποβάλλει τις προτάσεις της την Πέμπτη και δεσμεύεται για μεταρρυθμίσεις στο φορολογικό και στο συνταξιοδοτικό σύστημα αναφέρει στην επιστολή.

Η Ελλάδα καλωσορίζει επίσης την εξερεύνηση μέτρων για να καταστεί το δημόσιο χρέος βιώσιμο.

Ακολουθεί η επιστολή στα Αγγλικά.

08/07/2015 – ESM loan request letter on behalf of the Hellenic Republic

8 July 2015

Dear Chairperson and Managing Director,

On behalf of the Hellenic Republic (“the Republic” or “Greece”), I hereby present a request for stability support within the meaning of Articles 12 and 16 of the ESM Treaty given the risk to the financial stability of Greece as a member state and of the euro area as a whole.

Specifically, Greece seeks from the ESM a loan facility (“Loan” or “Programme”) with an availability period for three years in accordance with the conditions provided in Article 13 of the ESM Treaty and in Article 2 in the Guideline of Loans. The Loan will be used to meet Greece’s debt obligations and to ensure stability of the financial system.

Consistent with the principles of this medium to long term Programme, the Republic is committed to a comprehensive set of reforms and measures to be implemented in the areas of fiscal sustainability, financial stability, and long-term economic growth. Within the framework of the Programme, we propose to immediately implement a set of measures as early as the beginning of next week including:

• Tax reform related measures

• Pension related measures

We will also include additional actions that the Republic will undertake to further strengthen and modernize its economy. The Greek government will on Thursday 9 July at the latest set out in detail its proposals for a comprehensive and specific reform agenda for assessment by the three Institutions to be presented to the Euro Group.

In addition to the above, it is the expressed goal by the Greek government that by the end of the availability period of the Loan or earlier, it regains full and affordable market financing to meet its future funding requirements as well as sustainable economic and financial situation. As part of broader discussions to be held, Greece welcomes an opportunity to explore potential measures to be taken so that its official sector related debt becomes both sustainable and viable over the long term.

Greece is committed to honor its financial obligations to all of its creditors in a full and timely manner. We trust Member States appreciate the urgency of our Loan request at this time given the fragility of our banking system, our shortage of available liquidity, our upcoming obligations, our buildup of internal arrears, and our expressed desire to clear our outstanding arrears with the IMF and the Bank of Greece.

We reiterate the Greece’s commitment to remain a member of the Eurozone and to respect the rules and regulations as a member state. We look forward to your favorable and timely consideration of our request.

For avoidance of doubt, this letter supersedes our previous request letter dated 30 June 2015.

Yours faithfully,

Minister of Finance

http://www.ert.gr/to-elliniko-etima-gia-3etes-danio-apo-ton-esm/

Μετάφραση:

«Αγαπητέ Πρόεδρε και Γενικέ Διευθυντή

Εκ μέρους της Ελληνικής Δημοκρατίας («η Δημοκρατία» ή «Ελλάδα»), με την παρούσα σας παρουσιάζω αίτημα για στήριξη σταθερότητας στο πλαίσιο των άρθρων 12 και 16 της Συνθήκης ESM δεδομένου του κινδύνου για τη χρηματοοικονομική σταθερότητα της Ελλάδας ως κράτους μέλους και της ευρωζώνης στο σύνολό της.

Συγκεκριμένα, η Ελλάδα ζητά από τον ESM δανειακή διευκόλυνση («Δάνειο» ή «Πρόγραμμα») με περίοδο διαθεσιμότητας τριών ετών σύμφωνα με τους όρους που προβλέπονται στο Άρθρο 13 της Συνθήκης του ESM και του Άρθρου 2 στις Κατευθυντήριες Γραμμές των Δανείων. Το Δάνειο θα χρησιμοποιηθεί ώστε να εκπληρωθούν οι δανειακές υποχρεώσεις της Ελλάδας και για να διασφαλιστεί η σταθερότητα στο χρηματοπιστωτικό σύστημα.

Σύμφωνα με τις αρχές αυτού του Mεσομακροπρόθεσμου Προγράμματος, η Δημοκρατία δεσμεύεται σε μια ολοκληρωμένη σειρά μεταρρυθμίσεων και μέτρων που θα εφαρμοστούν στους τομείς της δημοσιονομικής βιωσιμότητας, της χρηματοοικονομικής σταθερότητας και της μακροπρόθεσμης οικονομικής ανάπτυξης.

Εντός του πλαισίου του Προγράμματος, προτείνουμε να εφαρμόσουμε άμεσα σειρά μέτρων, αρχής γενομένης ακόμα και από την αρχή της επόμενης εβδομάδας, συμπεριλαμβανομένων:

-Μέτρων που σχετίζονται με τη φορολογική μεταρρύθμιση

-Μέτρων που σχετίζονται με τις συντάξεις

Θα συμπεριλάβουμε επίσης επιπλέον ενέργειες που η Δημοκρατία θα αναλάβει ώστε να ενισχύσει και να εκσυγχρονίσει περαιτέρω την οικονομία της. Η ελληνική κυβέρνηση, το αργότερο μέχρι την Πέμπτη 9 Ιουλίου, θα ορίσει λεπτομερώς τις προτάσεις της για μια ολοκληρωμένη και συγκεκριμένη ατζέντα μεταρρυθμίσεων ώστε να αξιολογηθεί από τους τρεις θεσμούς για να παρουσιαστεί στο Eurogroup.

Μαζί με τα ανωτέρω αποτελεί στόχο της ελληνικής κυβέρνησης μέχρι το τέλος του προγράμματος ή και νωρίτερα να αποκτήσει ξανά πλήρη πρόσβαση στις αγορές ώστε να ανταποκριθεί στις μελλοντικές χρηματοδοτικές υποχρεώσεις της αλλά και να αποκτήσει διατηρήσιμη οικονομική και χρηματοοικονομική κατάσταση.

Ως μέρος των ευρύτερων συζητήσεων που θα πραγματοποιηθούν η Ελλάδα καλωσορίζει τη δυνατότητα να υπάρξουν πιθανά μέτρα ώστε το χρέος προς τον επίσημο τομέα να καταστεί διατηρήσιμο και βιώσιμο μακροπρόθεσμα.

Η Ελλάδα δεσμεύεται να τηρήσει τις χρηματοοικονομικές της υποχρεώσεις απέναντι σε όλους τους πιστωτές της πλήρως και εγκαίρως.

Ελπίζουμε ότι τα κράτη μέλη αντιλαμβάνονται το κατεπείγον του αιτήματός μας δεδομένων του εύθραυστου τραπεζικού συστήματος, της έλλειψης ρευστότητας, των επικείμενων υποχρεώσεων αλλά και της εκπεφρασμένης πρόθεσής μας να αποπληρώσουμε ληξιπρόθεσμες οφειλές στο ΔΝΤ και στην Τράπεζα της Ελλάδος.

Επαναλαμβάνουμε τη δέσμευση της Ελλάδας να παραμείνει μέλος της ευρωζώνης σεβόμενη τους κανόνες και τους κανονισμούς ως κράτος-μέλος. Αναμένουμε την έγκαιρη εξέταση του αιτήματός μας.

Αυτή η επιστολή υπερισχύει της προηγούμενης με ημερομηνία 30 Ιουνίου»

http://www.tovima.gr/finance/article/?aid=720552

Αυθημερόν ο Γ, Ντάισελμπλουμ ζήτησε την εξέταση του ελληνικού αιτήματος από ΕΚΤ και Κομισιόν

Μετάφραση:

Κύριο Πιέρ Μοσκοβισί.

Επίτροπο Οικονομικών και Νομισματικών Υποθέσεων, Φορολογίας και Τελωνειακών

Ευρωπαϊκή Επιτροπή

Κύριο Μάριο Ντράγκι

Πρόεδρο της Ευρωπαϊκής Κεντρικής Τράπεζας

Ευρωπαϊκή Κεντρική Τράπεζα

Αγαπητέ κύριε επίτροπε,

Αγαπητέ κύριε πρόεδρε,

Στις 8 Ιουλίου 2015 η Ελληνική Κυβέρνηση υπέβαλε ένα αίτημα για να λάβει στήριξη από τον Ευρωπαϊκό Μηχανισμό Σταθερότητας (ΕΜΣ) υπό τη μορφή δανείου.

Μετά την παραλαβή του προαναφερθέντος αιτήματος και βάσει του άρθρου 13(1) της Συνθήκης του ΕΜΣ σε συνδυασμό με το άρθρο 2 των κατευθυντήριων γραμμών του ΕΜΣ για την παροχή δανείων με την ιδιότητά μου ως προέδρου του Συμβουλίου Διοικητών του ΕΜ αναθέτω διά της παρούσης στην Ευρωπαϊκή Επιτροπή, σε συνεργασία με την ΕΚΤ, τις ακόλουθες εργασίες:

α) να εκτιμήσουν την πιθανότητα κινδύνου για την οικονομική σταθερότητα της ευρωζώνης στο σύνολό της ή των χωρών μελών της,

β) να εκτιμήσουν, σε συνεργασία με το Διεθνές Νομισματικό Ταμείο, αν το δημόσιο χρέος της Ελλάδας είναι βιώσιμο και

γ) να εκτιμήσουν τις πραγματικές ή τις πιθανές χρηματοδοτικές ανάγκες της Ελλάδας.

Βάσει του άρθρου 13 (2) της Συνθήκης του ΕΜΣ, οι εκτιμήσεις αυτές μαζί με το προαναφερθέν αίτημα και την πρόταση του διευθύνοντος συμβούλου του ΕΜΣ σύμφωνα με το άρθρο 2 των κατευθυντήριων γραμμών του ΕΜΣ για την παροχή δανείων θα αποτελέσουν τη βάση για την απόφαση του Συμβουλίου Διοικητών του ΕΜΣ για το αν θα παρασχεθεί, κατ΄αρχήν, στήριξη στην Ελλάδα υπό τη μορφή δανείου.

Με εκτίμηση,

Γερούν Ντάισλεμπλουμ

http://www.thepressproject.gr/article/79057/Auti-einai-i-apantisi-tou-ESM-metafrasmeni

Η ΕΠΙΣΤΟΛΗ ΤΣΙΠΡΑ

HELLENIC REPUBLIC THE PRIME MINISTER

To the President of the European Commission Mr. Jean Claude Juncker

To the President of the European Central Bank Mr. Mario Draghi

To the Managing Director of the IMF Ms Christine Lagarde

Dear President and Managing Director,

Athens, 09.07.2015

The attached proposal for a comprehensive and specific reform agenda by the Minister of Finance of Greece – aimed at complementing the request for a loan facility from the ESM of July 8 2015 – is conveyed to you following the Euro Summit decision of July 7 2015. In this context, it will be assessed by the three institutions to be presented to the Euro Group.

It constitutes the result of many months of formal and informal negotiations that the Greek government undertook with the institutions at all levels, aiming at reaching a program that will be economically viable and socially just.

With this proposal, the Greek people and the Greek government, confirm their commitment to, fulfilling reforms that will ensure Greece remains a member of the Eurozone, and ending the economic crisis. The Greek government is committed to fully implementing this reform agenda- starting with immediate actions – as well as to engaging constructively on the basis of this agenda, in the negotiations for the ESM Loan.

This reform agenda constitutes part of the wider effort of the Greek Government, towards reforming the Greek economy and public administration, through fighting corruption, clientilism and inefficiency, promoting social justice and creating a positive environment for sustainable economic growth.

Thanking you for our cooperation,

c.c. :

Yours sincerely,

Alexis Tsipras

– President of the European Council, Mr Donald Tusk

– Chairperson of the Board of the Governors of ESM and President of the Eurogroup, Mr Jeroen Dijsselbloem

– Managing Director of the ESM, Mr Klaus P. Regling.

Click to access TsiprasLetter_09-07-2015-1.pdf

Click to access Epistoli-Tsipra.pdf

εξουσιοδότηση έλαβαν μόλις στις 11 Ιουλίου :

Ν. 4333/11 Ιουλίου 2015 : Εξουσιοδότηση διαπραγματευτών για σύναψη νέας δανειακής σύμβασης (ESM)

Άρθρον Μόνον

Εν όψει της κατατεθείσας από την Ελληνική Κυβέρνηση αίτησης δανείου προς τον Ευρωπαϊκό Μηχανισμό Σταθερότητας (European Stability Mechanism, ESM) και βάσει του σχεδίου των μεταρρυθμίσεων για την Ελληνική οικονομία και των όρων για τη δημοσιονομική πολιτική της χώρας που κατατέθηκε στη Βουλή των Ελλήνων, η Βουλή των Ελλήνων εξουσιοδοτεί τον Πρωθυπουργό, τον Αντιπρόεδρο της Κυβέρνησης ως αναπληρωτή του, τον Υπουργό Οικονομικών και τον Υπουργό Επικρατείας, να διαπραγματευθούν με τους ομολόγους τους τους τελικούς όρους της συμφωνίας και να συνάψουν σύμβαση με τον Ευρωπαϊκό Μηχανισμό Σταθερότητας (ESM) για τη χρηματοδότηση του Δημοσίου χρέους για την περίοδο 2015−2018 και για τη διαπραγμάτευση λήψης μέτρων για τη βιωσιμότητα και εξυπηρετησιμότητα του μακροπρόθεσμου χρέους.

update

Αίτημα νέου δανεισμού και στο ΔΝΤ

«Οι ελληνικές αρχές έχουν δεσμευθεί να εφαρμόσουν μία σειρά από πολιτικές, οι οποίες θα ενδυναμώσουν τη δημοσιονομική βιωσιμότητα, θα ενισχύσουν τη χρηματοοικονομική σταθερότητα, τη μακροπρόθεσμη ανάπτυξη και, κυρίως, θα κατανείμουν το κόστος της οικονομικής προσαρμογής με τρόπο δίκαιο, διορθώνοντας έτσι τις αδικίες του παρελθόντος.

Βεβαίως, κάποια από αυτά τα μέτρα έχουν ήδη νομοθετηθεί. Εκτιμούμε, όμως, ότι θα χρειαστεί αρκετός χρόνος πριν η ελληνική οικονομία μπορέσει να ανταποκριθεί και να επιστρέψει σε ένα δυναμικό και βιώσιμο δρόμο ανάπτυξης με δικαιοσύνη και κοινωνική συνοχή.

Με βάση τα παραπάνω και με στόχο να ανταποκριθούμε σε αυτές τις προκλήσεις, έχουμε αιτηθεί μίας νέας τριετούς δανειακής σύμβασης, η οποία έχει ήδη γίνει κατ’ αρχήν δεκτή, και οι όροι της οποίας είναι σήμερα υπό διαπραγμάτευση.

Ως εκ τούτου, και κατ’ εφαρμογή της απόφασης της Συνόδου Κορυφής της 12ης Ιουλίου 2015, σας ενημερώνουμε ότι αιτούμεθα μίας νέας δανειακής διευκόλυνσης από το Διεθνές Νομισματικό Ταμείο.

Προσδοκούμε τη συνέχιση της συνεργασίας μας με το Ταμείο».

Επισυνάπτεται η επιστολή στα αγγλικά:

Επιστολή Ελληνικής Κυβέρνησης προς το ΔΝΤ

Reblogged this on Oxtapus *blueAction.

EFSF programme for Greece expires today

Date: 30 June 2015

Luxembourg – The Greek financial assistance programme of the European Financial Stability Facility (EFSF) expires tonight at midnight CET. As a result, the last EFSF loan tranche of €1.8 billion will no longer be available for Greece and the €10.9 billion in EFSF notes to cover the potential cost of bank recapitalisation or bank resolution in Greece will be cancelled.

Klaus Regling, CEO of the EFSF, said: “It is regrettable for Greece that the EFSF programme will expire today without any follow-up arrangement and that the positive results of the programme are put at risk. Due to the economic policies adopted under the EFSF programme, the country was on a good path towards strong growth until the second half of 2014. The many sacrifices which the Greek people had to make were paying off. Greece managed to cut its budget deficit and regain competitiveness. The country was able to access financial markets again and saw its high unemployment start declining. According to the OECD and World Bank, Greece was a reform champion until 2014, with encouraging growth prospects. This trend can continue if the Greek population decides to return to the path of reform within the euro area.”

The EFSF programme started on 21 February 2012. It was originally due to end on 31 December 2014, but was extended twice upon request of the Greek government. In the context of the programme, the EFSF disbursed €141.8 billion to Greece. It included €48.2 billion to cover the costs of bank resolution and recapitalisation. Of this amount, €10.9 billion in EFSF notes was not needed and was later returned to the EFSF. Accordingly, the outstanding loan amount stands at €130.9 billion. This makes the EFSF Greece’s largest creditor by far.

Greece’s financial assistance programme was unique in many aspects. Due to the seriousness of the country’s structural weaknesses and adjustment needs, it was the biggest EFSF or ESM programme ever. It also had by far the most favourable lending conditions ever granted to an EFSF or ESM programme country. It included Private Sector Involvement with sizeable losses for private investors. Greece benefits from an average loan maturity of over 30 years. The country pays neither interest rates nor redemption on the overwhelming part of its EFSF loans until 2023. These favourable lending conditions provided Greece with budgetary savings of over €16 billion for 2013 and 2014 combined. That corresponds to more than 4% of Greek GDP in each of the two years.

http://www.esm.europa.eu/press/releases/efsf-programme-for-greece-expires-today.htm

European Commission – Press release

Information from the European Commission on the latest draft proposals in the context of negotiations with Greece

Brussels, 28 June 2015

http://europa.eu/rapid/press-release_IP-15-5270_en.htm

Ευρωπαϊκή Επιτροπή – Δελτίο Τύπου

ΕΝΗΜΕΡΩΣΗ ΤΗΣ ΕΥΡΩΠΑΪΚΗΣ ΕΠΙΤΡΟΠΗΣ ΣΧΕΤΙΚΑ ΜΕ ΤΙΣ ΤΕΛΕΥΤΑΙΕΣ ΠΡΟΤΑΣΕΙΣ ΣΤΟ ΠΛΑΙΣΙΟ ΤΩΝ ΔΙΑΠΡΑΓΜΑΤΕΥΣΕΩΝ ΜΕ ΤΗΝ ΕΛΛΑΔΑ

Βρυξέλλες, 28 Ιούνιος 2015

http://europa.eu/rapid/press-release_IP-15-5270_el.htm

FAQ document on Greece

Last updated: 3 July 2015

1. How much has the EFSF disbursed to Greece?

The European Financial Stability Facility (EFSF) did not exist when the first programme of bilateral loans by the euro area Member States for Greece, the Greek Loan Facility (GLF), was agreed in early 2010. The EFSF programme, part of the second Economic Adjustmen tProgramme for Greece,started on 1March2012. TheEFSFhasdisbursed€130.9billion,makingitGreece’slargestcreditorbyfar.The GLF had a total volume of €52.9 billion. The International Monetary Fund (IMF) has disbursed €34.8 billion.

2. Did the euro area partners decide to end the EFSF programme for Greece?

No. Without an agreement to extend it, the EFSF programme expire d on 30 June. Greece’s euro area partners were prepared to extend the EFSF programme further, just as they had e xtended it twice in the past. Instead of ending on 31 December 2014, the EFSF Board of Directors’ decision of 19 December 2014 extended the programme until 28 February 2015. On 27 February 2015, the EFSF Board of Directors extended the availability period of the EFSF loan contract with Greece, called the Greek Master Financial Assistance Facility Agreement (MFFA), by a further four months, until 30 June 2015.

The EFSF made all the preparations necessary to further prolong the programme before the expiry date. Four days before the programme’s end, the Greek government abandoned negotiations and decided to hold a referendum on the terms of the extension as proposed by its partners, to take place aftertheprogrammeexpiry. Afternegotiatingforfivemonthsandacceptingmostofthetermson the table, the Greek government advised voters to reject the programme in the referendum. Under these circumstances, the Eurogroup decided that there was no possibility to extend the programme.

3. What are the amounts that Greece missed out on?

An extension wouldhaveallowedGreecetocontinuetobeeligibleforadisbursementofthelastEFSF loan tranche of €1.8 billion. Additionally, Greece could have benefitted from the €10.9 billion of EFSF funds that are earmarked for bank recapitalisation or bank resolution. With an extension of the EFSF programme, Greece would have been eligible in principle for a disbursement on 30 June to cover a €1.6 billion repayment to the IMF. It would also have had access to funds from related agreements including the transfer by euro area Member States of the profit from Greek government bonds held by Eurosystem central banks in an amount of €1.85 billion.

4. What happens with EFSF loans now that Greece defaulted on the IMF, and may default on the ECB?

For the EFSF, Greece officially defaulted on the IMF when the IMF Managing Director informed the IMF Board on 1 July 2015 that Greece failed to meet a payment obligation. According to the EFSF loan

contract (Master Financial Assistance Facility Agreement, MFFA) with Greece, such a default triggers the MFFA’s cross-default clause.

In line with a recommendation by the EFSF CEO, Klaus Regling, the EFSF Board of Directors decided on 3 July 2015 to opt for a Reservation of Rights on EFSF loans to Greece. The other two possible options were to request immediate repayment of its loans or to waive the EFSF’s right to action. By issuing a Reservation of Rights, the EFSF keeps all its options open as a creditor as events in Greece evolve. The situation will be continuously monitored and the EFSF will consider its position regularly.

A failed redemption of the maturing bond held by the ECB would mean Greece has defaulted on its obligation under the terms of that bond. If the amount is above €250 million it also triggers cross- default clauses.

6. Will this impact the EFSF’s market access?

There is no reason for the EFSF’s market access to be affected. Under the EFSF operating model, the irrevocable guarantees is sued by the euroarea Member States back the EFSF funding instruments and the EFSF’s ability to service its debt. In other words, the EFSF’s repayment capacity is not dependent on the ability of its debtors to honour their obligations in a timely fashion but on the credit strength of its guarantors. Market activity has sent no signal that investors doubt the validity of the EFSF guarantees.

7. What impact, if any, will this have on the EFSF rating?

All EFSF debt is backed by irrevocable and unconditional guarantees and over-guarantees provided by the euro area Member States. The EFSF rating therefore reflects the rating of its guarantors and not the credit quality of its borrowers, including Greece. According to the rating agencies’ assessments,theEFSF’sratingwouldnotbeimpactedevenunderanadversescenario,suchasa Greek default.

In addition, there is a strong willingness and commitment by all the guarantors to honour their guarantees and the EFSF has robust processes surrounding the need for a guarantee call. The Early Warning System and the asset and liability management processes enable the EFSF to anticipate the risk of a shortfall that would lead to a guarantee call well in advance of its execution.

Greece’s principal repayments are largely due between 2023 and 2054. Before that, Greece has only modest payments to make. These could be covered by the EFSF liquidity buffer or with further issuances. Therefore guarantee calls are unlikely in the foreseeable future.

8. Will the EFSF have to write off its exposure to Greece now?

No. There is no automatic connection between a default and writing off Greece’s debt. Even after a default, the EFSF expects to be repaid in full by Greece. EFSF bondholdersare in no way at risk, as EFSF bonds are guaranteed by shareholders.

9. Will Member States now have to supply the money Greece is not paying?

No. EFSF Members will only be asked to step in with cash if EFSF guarantees are called, which would only occur if the EFSF were at risk of failing to make a payment to EFSF bondholder s. In other words, aslongastheEFSFcontinuestohavefavourablemarketaccessandcan refinanceitsdebtinstruments, it will not need to call the guarantees from Member States. There is no reason to believe that the EFSF will lose this market access.

To clarify the EFSF guarantee structure: the EFSF member countries guarantee the issuance of EFSF bills and bonds, not the loans to Greece or other former programme countries. Therefore calling guarantees will only be required if the EFSF does not have the necessary liquidity to repay its bonds. In fact, principal repayments by Greece are largely due between 2023 and 2054. Before that, Greece has only modest payments to make which the EFSF liquidity buffer or with further issuances could cover until 2023. Therefore, the liquidity situation for the EFSF would not change over the coming years even if Greece decided not to fully repay its obligations.

The total amount of guarantees would be shared by the guarantors, according to their EFSF contribution key. Greece and Ireland are not guarantors of EFSF bonds. Portugal and Cyprus will honour any guarantee commitments they made before stepping out of the guarantee mechanism when receiving financial assistance.

Thus the potential yearly budget implications for each of the EFSF guarantors would be very limited. Ultimately, the EFSF, and thereby its shareholders, will retain its claim on Greece even if the guarantees are called and EFSF bondholders reimbursed. Any writedown of this claim can only occur by mutual agreement between the debtor and creditors.

10. Wasn’t it clear from the start that the EFSF strategy would not work in Greece?

No. The EFSF and ESM strategy of providing loans against macroeconomic reforms, called ‘conditionality’, worked successfully. Ireland, Spain, and Portugal reformed their economies and budgets, regained full market access at very favourable conditions, and started growing again. This shift had also begun in Greece. Current account and budget deficits were adjusted, signs of positive growth returned, and Greece became a top reformer, according to the Organisation for Economic Co- operation and Development and World Bank assessments. In response, the markets started to accept Greek debt issuance again. But these improvements were interrupted in late 2014, pushing investors away.

11. Why did the EFSF not write down its exposure to Greece in its 2014 annual accounts?

According to the International Financial Reporting Standards, the accounting standards used by the EFSF,sucha writedown,orimpairment,isrecordedonlywhenaspecificeventtriggersaloss.In2014, the EFSF did not identify such an event with respect to Greece, which the EFSF’s external auditor confirmed.

In 2014, Greece’s economy returned to growth after several years of recession. Uncertainty on the future direction of policies affected confidence from the beginning of 2015. European authorities closely reviewed the situation of Greece and its public finances during the first months of 2015. The EFSF took part in these discussions and closely monitored developments through its Early Warning System. No events that could be objectively qualified as loss-triggering were identified in 2015 in the periodleadinguptothefinalisationandapprovaloftheEFSF’sannualaccountsfor2014. In particular, Greece met all its scheduled payment obligations to the EFSF.

12. What kind of progress did Greece make in the implementation of reforms?

After six years of recession, Greece’s economy returned to growth in 2014. In recent years, Greece significantly improved its fiscal balance: the government deficit was reduced to -3.5% of gross domestic product (GDP) in 2014 from -12.3% in 2013. It recorded a positive primary balance (i.e. excluding interest payments on debt) of around 1% of GDP in 2014 which was expected to continue in the coming years.

Greece made important progress on public finances and completed the recapitalisation of the four largest banks. It also made headway in monitoring and correcting public expenditure, including the downsizing of the public administration. Labour cost competitiveness and the business environment improved. The government implemented several important structural reforms in health care, the opening of professions, and public financial management.

A major success for Greece was its return to the bond markets in 2014, when it issued 3-year and 5- year bonds. This was a sign that it had started to regain the trust of investors.

Background on the EFSF programme to Greece 13. What led to Greece’s economic problems?

In the decade before the crisis, Greece failed to modernise its economy towards efficiency and productivitygainswhile the public sector grewatunsustainablelevels. After Greece adopted the euro in 2001, it was able to borrow at much lower interest rates despite its deteriorating competitiveness and public finances.

Whilegovernmentspendingandborrowingincreased,taxrevenues –themainsourceofgovernment income – weakened due to poor tax administration. At the same time, rising wages undermined Greece’s competitiveness compared to other euro area countries. Low productivity and structural problems also contributed to the increasing economic difficulties. As a result, Greece’s economy contracted and unemployment began to climb to alarming levels.

Greece’s reliance on external financing for funding budget and trade deficits left its economy very vulnerable to shifts in investor confidence. In 2009, the Greek government revealed that previous governments had been misreporting government budget data. Much higher-than-expected deficit levels eroded investor confidence, causing the yields on Greek sovereign bonds, which correspond to the cost of borrowing money, to rise to unsustainable levels. The situation worsened to the point where the country was no longer able to refinance its borrowing, and it was forced to ask for help from its European partners and the IMF.

14. What did the first package of financial assistance for Greece consist of?

The first financial support programme for Greece, agreed in April 2010, consisted of bilateral loans from euro area Member States (known as the Greek Loan Facility, GLF), amounting to €52.9 billion, and a €20.1 billion loan from the IMF. The EFSF, which was only established in June 2010, did not take part in this programme.

15. What kind of reforms and policy measures did Greece agree to implement?

The objective of the macroeconomic adjustment programme was to durably restore Greece’s credibility with private investors by securing fiscal sustainability, safeguarding the stability of the financial system, and boosting potential growth and competitiveness.

This was to be achieved by carrying out fiscal consolidation, aimedat increasing government revenues and reducing expenses. Another major part of the programme was the implementation of structural reforms, including reforms in the: labour market to stimulate job creation and increase wage flexibility; product markets, especially in the services sector; public administration; and pension system. In addition, Greece was to privatise and restructure state-owned enterprises.

Reforms were also initiated to fight waste and corruption, along with measures to tackle tax evasion and step up collection of unpaid taxes.

16. Why was it necessary to have a second financial assistance package for Greece from the EFSF?

Greece made major efforts to implement wide-ranging measures, which were tiedto the first financial assistance package. The challenges confronting Greece remained significant, however, with a large competitiveness gap, a large fiscal deficit, a high level of public debt, and an undercap italised banking system. The economic recession in Greece proved to be more serious and damaging than expected. The financial assistance provided under the first programme through bilateral loans from euro area countries and the IMF was not sufficient for Greece to make the necessary adjustments and to regain market access.

Furthermore,Greece’spublic debt-to-GDP ratio was considered unsustainable. A restructuring of debt held by private creditors became necessary to bring the total debt level back to a sustainable path. Additional time and funds were required to underpin Greece’s fiscal consolidation efforts with structural reforms, to boost growth, and improve competitiveness.

17. What was the Private Sector Involvement (PSI) and what was the EFSF’s role in it?

Under the PSI, the Greek debt held by private investors, mainly banks, was restructured in March 2012 to lighten Greece’s overall debt burden. About 97% of privately held Greek bonds(about €197 billion) took a 53.5% cut of the face value (principal) of the bond, corresponding to an approximately €107 billion reduction in Greece’s debt stock.

The EFSF provided two facilities to Greece to encourage bondholders to participate in the PSI. These were the:

o PSI facility – as part of the voluntary debt exchange, Greece offered investors 1- and 2-year EFSF bonds. These EFSF bonds, provided to holders of bonds under Greek law, were subsequently rolled over into longer maturities.

o Bond interest (accrued interest) facility – to enable Greece to repay accrued interest on outstanding Greek sovereign bonds under Greek law which were included in the PSI. Greece offered investors EFSF 6-month bills. The bills were subsequently rolled over into longer maturities.

18. What decisions did the Eurogroup take in November 2012?

When the second programme was agreed, the Eurogroup noted that the outlook for the sustainability of Greek government debt had worsened compared to March 2012, mainly due to a deteriorated macroeconomic situation and delays in programme implementation. Therefore, the Eurogroup approved a set of measures designed to ease Greece’s debt burden and bring its public debt back to a sustainable path, so that debt-to-GDP couldbe reduced to 124% by 2020 and to substantiallybelow 110% by 2022. These measures included:

o reducing the interest rate charged to Greece on the bilateral loans provided by the Greek Loan Facility (GLF) by 100 basis points.

o cancellingtheEFSFguaranteecommitmentfee(conditionaluponthecontinued implementation of reforms by Greece) of 10 basis points, which Greece pays on the EFSF loans. It is estimated that this measure will save a total of €2.7 billion over the entire period of EFSF lending to Greece.

o extending the maturity of GLF and EFSF loans by 15 years (to an average loan maturity of over 30 years), significantly improving the country’s debt profile.

o deferring interest rate payments on EFSF loans by 10 years, allowing Greece to reduce substantially its financing needs after a decade. This operation will not create any costs for the EFSF since Greece will pay interest charges on the deferred interest. It is estimated that this measure will lower the country’s financing needs by €12.9 billion by 2022.

o passing on to Greece an amount equivalent to the income of the ECB’s Securities Markets Programme (SMP) portfolio accruing to their national central bank as from budget year 2013.

19. How did Greece benefit from the extension of loan maturities and def erral of interest payments decided in November 2012?

The extension of loan maturities and deferral of interest payments significantly reduced Greece’s annual financing needs. This was instrumental in helping to bring Greece ’s public debt service back to a sustainable path, and made it easier for Greece to return to bond markets in 2014.

EFSF financial assistance in general has generated substantial savings for Greece: in 2013, these savings amounted to €8.6 billion, or 4.7% of Greece’s GDP. For 2014, they were €7.9 billion, or 4.4% of Greece’s GDP (based on reasonable assumptions; for details see the ESM 2013 and 2014 Annual Reports).ThesesavingswerepossiblebecausetheEFSFprovidedloanstoGreece(aswellastoIreland and Portugal) at much lower interest rates than those that the market theoretically would have offered.

The savings increase further when we include all the other measures the euro area governments took to alleviate Greece’s debt burden, such as the extension of the maturity of the EFSF and bilateral GLF loans to more than 30 years, the reduction in the GLF interest rates, the 10-year interest rate deferral or the cancelation of the interest rate margin. All combined, these improvements produced an economic reduction of the debt burden of 49% of Greece’s 2013 GDP orof50% of the European official sector loans.Thesesavingsgreatlyimproveddebtsustainabilityandprovided Greece with fiscal space.

Click to access 2015_07_03%20FAQ%20on%20Greece%20-%20update.pdf

Pingback: Γιατί ΑΠΕΧΩ ἀπό τό σημερινό δημοψήφισμα; | Φιλονόη

AN UPDATE OF IMF STAFF’S PRELIMINARY PUBLIC DEBT SUSTAINABILITY ANALYSIS

Greece’s public debt has become highly unsustainable. This is due to the easing of policies during the last year, with the recent deterioration in the domestic macroeconomic and financial environment because of the closure of the banking system adding significantly to the adverse dynamics. The financing need through end-2018 is now estimated at Euro 85 billion and debt is expected to peak at close to 200 percent of GDP in the next two years, provided that there is an early agreement on a program. Greece’s debt can now only be made sustainable through debt relief measures that go far beyond what Europe has been willing to consider so far.

This document was distributed to the Executive Board of the IMF on the evening of July 10, 2015, and to the finance ministers of euro area member states in the morning of July 11, 2015. It was neither discussed nor approved by the IMF’s Executive Board.

Copies of this report are available to the public from

International Monetary Fund Publication Services PO Box 92780 Washington, D.C. 20090 Telephone: (202) 623-7430 Fax: (202) 623-7201 E-mail: publications@imf.org Web: http://www.imf.org Price: $18.00 per printed copy

International Monetary Fund Washington, D.C.

© 2015 International Monetary Fund

GREECE: AN UPDATE OF IMF STAFF’S PRELIMINARY PUBLIC DEBT SUSTAINABILITY ANALYSIS

Greece’s public debt has become highly unsustainable. This is due to the easing of policies during the last year, with the recent deterioration in the domestic macroeconomic and financial environment because of the closure of the banking system adding significantly to the adverse dynamics. The financing need through end-2018 is now estimated at Euro 85 billion and debt is expected to peak at close to 200 percent of GDP in the next two years, provided that there is an early agreement on a program. Greece’s debt can now only be made sustainable through debt relief measures that go far beyond what Europe has been willing to consider so far.

1. The IMF staff’s most recent DSA was published less than two weeks ago (attached here). It noted that:

(i)About a year ago, if program policies had been implemented as agreed, no further debt relief would have been needed to reach the targets under the November 2012 framework (debt of 124percent of GDP by 2020 and “substantially below” 110 percent of GDP by 2022).

(ii)But the significant shortfalls in program implementation during the last year led to a significant increase in the financing need—by more than Euro 60 billion—estimated only a few weeks ago. As a result, debt-to-GDP by 2022 was projected to increase from an estimate less than a year ago of about 105 percent to a revised estimate of 142 percent, significantly above the target of 110 percent of GDP. This would under the November 2012 agreement have implied significant additional measures to reduce the face-value of debt.

(iii) However, as detailed in the published DSA—in view of the fact that most of the debt was now owed to official European creditors on non-market terms—a case could be made for changing from the stock-of-debt framework agreed in November 2012 to a framework focused on the path of gross financing needs. This would support the conclusion that haircuts could be avoided if instead there was a significant further extension of the maturities of the entire stock of European debt (GLF, EFSF), in the form of a doubling of grace and repayment periods, with similarly concessional terms on new financing. At the core of this conclusion is the fundamental premise that public debt cannot be assumed to migrate back onto the balance sheet of the private sector at interest rates consistent with debt sustainability until debt is much lower. Greece cannot return to markets anytime soon at interest rates that it can afford from a medium-term perspective.

2.The events of the past two weeks—the closure of banks and imposition of capital controls—are extracting a heavy toll on the banking system and the economy, leading to a further significant deterioration in debt sustainability relative to what was projected in our recently published DSA. A full and comprehensive revision of this debt sustainability analysis can only be done at a later stage, taking into account the deterioration in the economic situation as a result of the closing of the banking system and the details of policies yet to be agreed. However, it is already clear at this stage that there will be a significant increase in the financing need. The preliminary (mutually agreed) assessment of the three institutions is that total financing need through end-2018 will increase to Euro 85 billion, or some Euro 25 billion above what was projected in the IMF’s published DSA only two weeks ago, largely on account of the estimated need for a larger banking sector backstop for Euro 25 billion. Adjusting our recent DSA mechanically for these changes, and taking into account the agreed weaker growth path for the next two years, gives rise to the following main revisions:

a. Debt would peak at close to 200 percent of GDP in the next two years. This contrasts with earlier projections that the peak in debt—at 177 percent of GDP in 2014—is already behind us.

b. By 2022, debt is now projected to be at 170 percent of GDP, compared to an estimate of 142 percent of GDP projected in our published DSA.

c. Gross financing needs would rise to levels well above what they were at the last review (and above the 15 percent of GDP threshold deemed safe) and continue rising in the long term.

3. Moreover, these projections remain subject to considerable downside risk, suggesting that there could be a need for additional further exceptional financing from Member States with an attendant deterioration in the debt dynamics:

(i) Medium-term primary surplus target: Greece is expected to maintain primary surpluses for the next several decades of 3.5 percent of GDP. Few countries have managed to do so. The reversal of key public sector reforms already in place— notably pension and civil service reforms—without yet any specification of alternative reforms raises concerns about Greece’s ability to reach this target. Moreover, the failure to resist political pressures to ease the target that became evident as soon as the primary balance swung into surplus also raise doubts about the assumption that such targets can be sustained for prolonged periods. The Government and its European partners need to address these concerns in the coming months.

(ii) Growth: Greece is still assumed to go from the lowest to among the highest productivity growth and labor force participation rates in the euro area, which will require very ambitious and steadfast reforms. For this to happen, the Government— which has put on hold key structural reforms—would need to specify strong and credible alternatives in the context of the forthcoming program discussions.

(iii) Bank support: the proposed additional injection of large-scale support for the banking system would be the third such publicly funded rescue in the last 5 years.

Further capital injections could be needed in the future, absent a radical solution to the governance issues that are at the root of the problems of the Greek banking system. There are at this stage no concrete plans in this regard.

4. The dramatic deterioration in debt sustainability points to the need for debt relief on a scale that would need to go well beyond what has been under consideration to date—and what has been proposed by the ESM. There are several options. If Europe prefers to again provide debt relief through maturity extension, there would have to be a very dramatic extension with grace periods of, say, 30 years on the entire stock of European debt, including new assistance. This reflects the basic premise that debt cannot be assumed to migrate back onto the balance sheet of the private sector at interest rates close to the current AAA rates before debt levels have been brought to much lower levels; borrowing at anything but AAA rates in the near term will bring about an unsustainable debt dynamic for the next several decades. Other options include explicit annual transfers to the Greek budget or deep upfront haircuts. The choice between the various options is for Greece and its European partners to decide.

Click to access cr15186.pdf

Αυτή είναι η συμφωνία -3ετές Μνημόνιο, 86 δισ. δάνειο, όλα τα μέτρα

Ενα νέο 3ετές Μνημόνιο συμφώνησε να διαπραγματευθεί ο Αλέξης Τσίπρας με τους Ευρωπαίους εταίρους. Η διαπραγμάτευση θα ξεκινήσει μετά την ψήφιση από τη Βουλή των προαπαιτούμενων μέτρων.

Πόση είναι η χρηματοδότηση

Η νέα σύμβαση προβλέπει δάνειο 86 δισ. ευρώ μέσω του ESM (Ευρωπαϊκός Μηχανισμός Σταθερότητας). Θα συμμετέχει και το ΔΝΤ, το οποίο θα εκταμιεύσει επιπλέον 16 δισ. ευρώ από το τρέχον πρόγραμμά του. Η ελληνική κυβέρνηση έδωσε μάχη για να μη συμμετάσχει το ΔΝΤ, αλλά δεν τα κατάφερε.

Αναπτυξιακό «πακέτο» 35 δισ. ευρώ (το λεγόμενο «πακέτο Γιούνκερ»).

Αναδιάρθρωση χρέους: Το Eurogroup και οι Ευρωπαίοι ηγέτες απέκλεισαν το ονομαστικό κούρεμα χρέους. Επέλεξαν «σημαντικό πακέτο μέτρων για τη στήριξη της βιωσιμότητας του ελληνικού χρέους».

Ταμείο ιδιωτικοποίησης δημόσιας περιουσίας 50 δισ. ευρώ

Μετά από μάχη που δόθηκε, δεν θα έχει την έδρα του στο Λουξεμβούργο, αλλά στην Ελλάδα. Στο Ταμείο αυτό θα περάσουν περιουσιακά στοιχεία του ελληνικού Δημοσίου. Από τις πωλήσεις και την αξιοποίηση της περιουσίας, τα 25 δισ. ευρώ θα ενισχύσουν τις τράπεζες, τα 12,5 δισ. ευρώ ευρώ θα εξυπηρετήσουν το χρέος και το υπόλοιπα 12,5 δισ. ευρώ θα κατευθυνθούν σε επενδύσεις, τις οποίες θα αποφασίσει η Ελλάδα.

Επιτήρηση και παρουσία των τριών Θεσμών στην Αθήνα

Ποια μέτρα καλείται να περάσει η Βουλή ως την Τετάρτη

Η Ελλάδα καλείται ως την Τετάρτη 15 Ιουλίου να περάσει από τη Βουλή προαπαιτούμενα μέτρα, με 4 νόμους, ως εξής:

Μεταρρυθμίσεις στο αφαλιστικό, αύξηση ΦΠΑ, μεταρρύθμιση της αγοράς εργασίας και επαγγελμάτων, την απόλυτη ανεξαρτητοποίηση της ΕΛΣΤΑΤ.

Ολα τα μέτρα της νέας συμφωνίας

Ο ΦΠΑ στην εστίαση ανεβαίνει άμεσα από το 13% στο 23%.

Στα ξενοδοχεία μετακινείται από το 6,5% στο 13% από τον Οκτώβριο του 2015.

Σταδιακή κατάργηση της έκπτωσης του ΦΠΑ στα νησιά από τον Οκτώβριο του 2015, δηλαδή κοσμικά νησιά, με εξαίρεση την άγονη γραμμή.

Εφαρμόζεται από τον Ιούλιο 2015 σταδιακή αύξηση του ορίου ηλικίας συνταξιοδότησης, που θα φτάσει το 2022 το 67ο έτος ηλικίας ή το 62ο με 40 χρόνια εισφορών.

Εξαιρούνται βαρέα και ανθυγιεινά και μητέρες τέκνων με αναπηρία.

Σταδιακή κατάργηση του ΕΚΑΣ για όλους ως το τέλος του 2019.

Αύξηση των εισφορών των συνταξιούχων για ιατροφαρμακευτική περίθαλψη από το 4% στο 6% σε κύρια και επικουρικά ταμεία

Ενοποίηση όλων των επικουρικών ταμείων υπό το ΕΤΑ ως την 1η Ιανουαρίου.

Ιδιωτικοποίηση του ΑΔΜΗΕ

Μεταρρυθμίσεις στην αγορά εργασίας και εφαρμογή της εργαλειοθήκης του ΟΟΣΑ

Ανοιχτά καταστήματα τις κυριακές, αλλαγή στην ιδιοκτησία των φαρμακείων, γάλακτος, αρτοποιείων, άνοιγμα των κλειστών επαγγελμάτων

Μείωση αμυντικών δαπανών κατά 100 εκατ. ευρώ το 2015 και κατά 200 εκατ. ευρώ το 2016.

Ενεργοποιούνται οι διαγωνισμοί για ΟΛΠ και ΟΛΘ ως το τέλος Οκτωβρίου 2015

Θα ολοκληρωθούν οι διαγωνισμοί για τα περιφερειακά αεροδρόμια, την ΤΡΑΙΝΟΣΕ, την Εγνατία οδό και το Ελληνικό

Τα περιφερειακά αεροδρόμια θα πωληθούν στον νικητή του διαγωνισμού με τους ισχύοντες όρους.

Ενιαίο μισθολόγιο στο Δημόσιο από 1.1.2016 με αναπροσαρμογές στους μισθούς ανάλογα με τα προσόντα και τη θέση ευθύνης.

Νέο μόνιμο σχήμα κινητικότητας στο Δημόσιο από τον Οκτώβριο του 2015

Το ανακοινωθέν της Συνόδου Κορυφής

Τσίπρας: Πήραμε την ευθύνη της απόφασης

«Δώσαμε μια σκληρή μάχη έξι μήνες τώρα, μέχρι τέλους παλαίψαμε για να διεκδικήσουμε ό,τι καλύτερο για μια συμφωνία που θα δώσει την ευκαιρία στην χώρα να σταθεί στα πόδια της», δήλωσε ο πρωθυπουργός, Αλέξης Τσίπρας, μετά την επιτυχή κατάληξη των μαραθώνιων διαβουλεύσεων για το ελληνικό θέμα, στις Βρυξέλλες. «Βρεθήκαμε μπροστά σε δύσκολες αποφάσεις, σε σκληρά διλήμματα. Πήραμε την ευθύνη της απόφασης προκειμένου να αποτρέψουμε τις επιδιώξεις ακραίων συντηρητικών κύκλων», πρόσθεσε ο πρωθυπουργός, χαρακτηρίζοντας «δύσκολη την συμφωνια». Επισήμανε όμως ότι «κερδίσαμε την αναδιάρθρωση του χρέους» και την χρηματοδότηση της ανάπτυξης.

Τουσκ: Οι ΥΠΟΙΚ κατεπειγόντως να συμφωνήσουν πώς θα βοηθηθεί η Ελλάδα

Την ικανοποίηση τους για τη συμφωνία που επιτεύχθηκε στο θεμα της Ελλάδας εξέφρασαν τη Δευτέρα το πρωί από τις Βρυξέλλες ο πρόεδρος της Κομισιόν Ζαν Κλοντ Γιούνκερ, του Ευρωπαϊκού Συμβουλίου Ντόναλντ Τουσκ και του Eurogroup Γερούν Ντάισελμπλουμ.

Οι τρεις πρόεδροι χαιρέτισαν την εποικοδομητική στάση της Ελλάδας επισημαίνοντας ότι θα υπάρξει χρηματοδότηση βραχυπρόθεσμου χαρακτήρα ούτως ώστε η Ελλάδα να ανταποκριθεί στο εγγύς μέλλον στις άμεσες υποχρεώσεις της.

«Οι υπουργοί Οικονομικών κατεπειγόντως θα πρέπει να συμφωνήσουν πώς θα βοηθηθεί η Ελλάδα» τόνισε ο κ. Τουσκ. Πράγματι, το Eurogroup συνεδριάζει το απόγευμα της Δευτέρας στις Βρυξέλλες για να αποφασίσει για το πρόγραμμα-γέφυρα και για τα χρήματα που θα χρειαστεί άμεσα η Ελλάδα.

Ο πρόεδρος της Επιτροπής Γιούνκερ ανέφερε ότι τώρα είναι δυνατή η εφαρμογή ενός προγράμματος ανάπτυξης της ελληνικής οικονομίας με κονδύλια ύψους 35 δισ. Ευρώ, το λεγόμενο «πακέτο Γιούνκερ».

Πηγή: Αυτή είναι η συμφωνία -3ετές Μνημόνιο, 86 δισ. δάνειο, όλα τα μέτρα | iefimerida.gr http://www.iefimerida.gr/news/216912/ayti-einai-i-symfonia-3etes-mnimonio-86-dis-daneio-ola-ta-metra#ixzz3mAY1Gc4k

09-07-2015

«Χάθηκαν» 210 δισ. ευρώ από τον Ιανουάριο έως σήμερα!

Ξεπερνούν τα 210 δισ. ευρώ οι άμεσες και «παράπλευρες» απώλειες στην ελληνική οικονομία, μετά το «ναυάγιο» της διαπραγμάτευσης κυβέρνησης και εταίρων από τις εκλογές του Ιανουαρίου έως σήμερα.

Την ώρα που από τις τράπεζες έφυγαν 54 δισ. ευρώ καταθέσεων, το ύψος του ELA έφτασε στα 89 δισ. ευρώ. Αντίστοιχα, οι απώλειες στο Χρηματιστήριο της Αθήνας αγγίζουν τα 13 δισ. ευρώ, ενώ «χάθηκαν» εξαιτίας της λήξης του προγράμματος τα 11 δισ. ευρώ του EFSF για την ανακεφαλαιοποίηση των τραπεζών.

Σε 4,5 δισ. ευρώ υπολογίζονται οι άμεσες και σε 13 δισ. ευρώ οι έμμεσες απώλειες από τις ιδιωτικοποιήσεις και επενδύσεις που ακυρώθηκαν (περιφερειακά αεροδρόμια, ΟΛΠ, Ελληνικό, ΑΔΜΗΕ, «Αστέρας»), ενώ η υστέρηση στα δημόσια έσοδα υπολογίζεται σε 5,5 δισ. ευρώ.

Τέλος, περίπου 15 δισ. ευρώ έχουν χαθεί από την κάμψη του ΑΕΠ και 6 δισ. ευρώ από τις ακυρώσεις στον τουρισμό.

http://www.emea.gr/«χάθηκαν»-210-δισ.-ευρώ-από-τον-ιανουάριο/452393

ΤΙ ΕΙΝΑΙ ΤΟ Eurogroup ;;;

Η Ευρωομάδα (ευρύτερα γνωστή ως Eurogroup) είναι η ανεπίσημη σύσκεψη των Υπουργών Οικονομικών της Ευρωζώνης, δηλαδή των Υπουργών Οικονομικών των χωρών της Ευρωπαϊκής Ένωσης οι οποίες έχουν ως επίσημο νόμισμά τους το Ευρώ, του Αντιπροέδρου της Ευρωπαϊκής Επιτροπής για τα Οικονομικά και το Ευρώ αλλά και του Προέδρου της Ευρωπαϊκής Κεντρικής Τράπεζας[1]. Στη σύσκεψη προεδρεύει ο διορισμένος πρόεδρος της, ο οποίος και το εκπροσωπεί σε άλλα εκτελεστικά όργανα και προς το κοινό. Η Ευρωομάδα συνεδριάζει άτυπα μια φορά το μήνα, πριν την σύνοδο των υπουργών οικονομικών της Ευρωπαϊκής Ένωσης (το ECOFIN)[2]. Το Eurogroup αναγνωρίστηκε ως όργανο με πρωτόκολλο της Συνθήκης της Λισσαβώνας[3].

Eurogroup

The Eurogroup is the recognised collective term for informal meetings of the finance ministers of the eurozone, i.e. those member states of the European Union (EU) which have adopted the euro as their official currency.

The group has 19 members. It exercises political control over the currency and related aspects of the EU’s monetary union such as the Stability and Growth Pact. Its current president is Dutch finance minister Jeroen Dijsselbloem.

The ministers meet in camera a day before a meeting of the Economic and Financial Affairs Council (Ecofin) of the Council of the European Union. They communicate their decisions via press and document releases. This group is related to the Council of the European Union (only Eurogroup states vote on issues relating to the euro in Ecofin) and was formalised under the Lisbon Treaty.

Legal basis[edit]

Wikisource has original text related to this article:

Protocol on the Euro Group

Prior to the Lisbon Treaty, the Eurogroup had no legal basis. A formal legal basis was granted for the first time under the Lisbon Treaty when it came into force on 1 December 2009. Protocol 14 of the treaty lays out just two articles to govern the group;

Article 1: The Ministers of the Member States whose currency is the euro shall meet informally. Such meetings shall take place, when necessary, to discuss questions related to the specific responsibilities they share with regard to the single currency. The Commission shall take part in the meetings. The European Central Bank shall be invited to take part in such meetings, which shall be prepared by the representatives of the Ministers with responsibility for finance of the Member States whose currency is the euro and of the Commission.

Article 2: The Ministers of the Member States whose currency is the euro shall elect a president for two and a half years, by a majority of those Member States.

— Protocol 14 of the Consolidated Treaties of the European Union (as amended by the Treaty of Lisbon)[14]

Furthermore, the treaty amended the Council of the EU’s rules so that when the full Ecofin council votes on matters only affecting the eurozone, only those states using the euro (the Eurogroup countries) are permitted to vote on it.[15]

ΥΠΕΝΘΥΜΙΣΗ

ΟΙ ΥΠΟΥΡΓΟΙ (είτε πρώτοι είτε δεύτεροι είτε τρίτοι στην κατάταξη όπως ο πρωθυπουργός, ο υπουργός οικονομικών κλπ) ΕΙΝΑΙ ΜΕΛΗ ΤΗΣ ΕΚΤΕΛΕΣΤΙΚΗΣ ΚΑΙ ΟΧΙ ΤΗΣ ΝΟΜΟΘΕΤΙΚΗΣ ΕΞΟΥΣΙΑΣ. ΔΗΛΑΔΗ ΕΙΝΑΙ ΕΚΕΙΝΟΙ ΠΟΥ ΕΚΤΕΛΟΥΝ ΤΟΥΣ ΝΟΜΟΥΣ ΠΟΥ ΨΗΦΙΣΑΝ ΟΙ ΑΝΤΙΠΡΟΣΩΠΟΙ ΤΩΝ ΛΑΩΝ ΗΤΟΙ ΟΙ ΒΟΥΛΕΥΤΕΣ

Greece debt crisis: Did Greece just submit the same proposals 61% of Greeks voted against?

http://www.independent.co.uk/news/business/news/greece-debt-crisis-live-did-greece-just-submit-the-same-proposals-61-of-greeks-voted-against-10380268.html

Ενημερωθείτε και ενημερώστε: Ευρωπαϊκό Μηχανισμό Σταθερότητας (European Stability Mechanism – ESM)

Memorandum–steamroller for the Greek people

2 June by Leonidas Vatikiotis

The prerequisites passed by a tiny majority 153 MPs (in an overall number of 300) of the Greek government on May 18th, equivalents to a new super-memorandum, as the new measures which further deepen the poverty extend up to 2021, three years after the end of the current 3rd programme, on August of 2018.

The new Memorandum (3rd in a row voted by the MPs of SYRIZA and ANEL, after the agreement of August 2015 and the May 2016 pre-requisites) is sacrificing on the altar of the budget surpluses any potential of GDP growth that may existed. The GDP shrinking by 0.5% in the first quarter of 2017 already cancels the optimistic projections for the reduction of unemployment, which had been incorporated in the budget this year. It is not at all coincidence that the projected GDP growth of 2017 included in the Medium Term is limited to 1.8%, much lower than the 2.7% provided by the state budget

The measures included in the 4th Memorandum, which have been quantified in the Medium-Term Budgetary Objective of the 2018-2021 Program, tantamount to whirlwind and can be divided into four general categories.

Recovery measures

Direct impact on disposable income of citizens, namely deepening poverty, will be brought by seven measures:

Reduction in pensions

The so-called personal difference between primary and supplementary pensions came into the government’s target, with the reduction reaching even 18% of the paid pension. In absolute numbers the reduction will reach an average of 185 euros per month and in some cases up to 300 euros, while it is expected to affect about 1.35 million pensioners.

In the first line of fire will be thrown the pensioners from the former TEVE (Self-employed Insurance Agency), retired doctors, lawyers, engineers and pharmacists, double-pensioners, etc. The measure will be applied from January 1, 2019. Losses will also suffer the young pensioners who will retire by 31/12/2018.

JPEG – 53.5 kb

EU Commission welcomes voting of measures in the Greek parliament

Reduction of the tax-free income

This measure, which according to Minister of Economy, Eykl. Tsakalotos, would be the reason of his resignation, if passed, will be applied on 1 January 2020 and is expected to burden each family with an average of 600 euros per year. The new tax-free income threshold, which will exclusively hit the poor, develops as follows:

– 1,250 euros (from 1.900 euros) for taxpayers with no children

– 1,300 euros (from 1.950 euros) for taxpayers with 1 protected child

– 1,350 euros (from 2.000 euro) for taxpayers with 2 protected children

– 1,450 euros (from 2,100) for taxpayers with 3 or more protected children

The savings to the State budget or else the cost that the pensioners will pay from the pension cuts in 2019 amount to 2.26 billion EUR and the cost that the taxpayers will pay from the drastic reduction in the tax-free income starting in 2020, is EUR 1.92 billion..

Increase in insurance contributions

In article 58 provides that as from 1/1/2018 insurance contributions of freelancers and the self-employed will be calculated on the monthly income, including contributions.

Article 58 stipulates that as of January 1st 2018 the freelances and the self-employed insurance contributions will be calculated on the monthly income, including insurance contributions. This is an unprecedented robbery – a confession of the failure of EFKA (Single Social Security Institution), as contributions will be calculated on non-existent income! According to calculations made by professional parties, the consequent increase, in relation to the current year, may reach up to 37%!

Reductions in special wage regimes

Officers of the army, the police, the Fire Brigade and the Coast Guard fiercely reacted, forcing the Government in the last minute to propose allowances in order to close the rift triggered by the reductions caused by the shrinkage of wage levels. On the grounds of rationalisation, the government attempted to remove allowances that led to more sustainable wage levels.

Moreover, according to a statement by POSDEP (Panhellenic Federation Of Faculty Associations & Research Staff), wage cuts were also made in Universities, dismissing the proclamations of the Minister of Education, Mr. Gavroglou ,at the Rectors’ Meeting on May 13th, for increases in the salaries of professors of all levels ranging from 2.5% to 7.5%. These increases, even if they had been applied, they would have been absorbed by the tax increases…

Reductionof grants to municipalities and Regions

Based on Article 8OA, from January 1st 2018 the total amount to be transferred annually from the regular budget to Municipalities and Regions must not exceed € 3.4 billion. The decision is justified as follows: since the municipalities managed to draw up and implement balanced budgets, they do not need the Central Independent Resources! Therefore, it is obvious where this famous ” financial independence ” of the municipalities leads: to the gradual withdrawal of the State from funding and the transferring the cost on the citizens’ backs.

Taxation of short-term tenancy of real-estate in the context of sharing economy

This particular request, which is contained in Articles 83 and 84, increases significantly the cost of Airbnb and was a requirement of the hoteliers in order to reduce the gap in prices between hotels and short-term leases from electronic platforms that made hotels unprofitable.

Further use of generic medicines.

Article 88 encourages pharmacies to prescribe more and more often cheap generic medicines with the incentive of a compulsory deduction from the pharmaceutical companies if the generics exceed 25% of the medicines included in the prescriptions. This percentage may be adjusted annually, by decision of the Minister of Health. Moreover, goals incorporated into the e-prescription system may be set for every doctor, as well as penalties! As a result, pharmaceutical expenditure, will be reduced, on the benefit of the State Budget, with unknown however effect on the health of the insured.

The Scientific Committee of the Parliament has already expressed reservations about the constitutionality of the cuts in pension rights and special wages. In a lengthy report, the Committee questioned whether or not a fair balance between the requirements of the general interest, as invoked by the government, and the protection of the fundamental rights of the individual is guaranteed. Of course, SYRIZA, like all the other governments that signed a Memorandum, didn’t give a hoot …

Measures of Real Existing Liberalism

Chapter E, which is entitled “Provisions of competence of the Ministry of Justice”, describes all the details of the amendment of the Code of Civil Procedure in order to permit the beginning of electronic auctions. Government and bankers under the fear of popular reactions that culminated in the previous period, set up the institutional framework that will allow the bloodless persecution of thousands of borrowers from their houses, without publicity. The amended Article 959.1 of the Code of Civil Procedure suggestively states that “electronic auction is carried out by the certified electronic auctioneer notary, through the electronic auction systems. Electronic auctions are held on Wednesdays or Thursdays or Fridays from 10.00 to 14.00 or from 14.00 to 18.00.”

According to the provisions of the Financial Agreement there will be a tightening of the budgeting procedures. An amendment to Law 4270/2014 provides that the submission of the preliminary draft of the annual State Budget is subject to the Financial Council’s observation that it is complied with the provisions of the Financial Agreement (Article 66).

Release of the sale of Non-Prescription Drugs! Confident enough, that the sale of medicines in supermarkets will result in the increase of their prices, the Government is rushing to impose maximum prices for their purchase by the health system, so as not to burden the budget. As for the burden of the citizens, it is left to the mood of the pharmaceutical industry …

As ordered by the Domestic Troika, that is to say, of specific business interests that speak directly with the government, Article 49, provides the operation of stores on Sundays from May to October, with the exception of the second Sunday of August. In fact, paragraph 2 removes all prior restrictions on the landsize, the legal relationship with chain of stores, and so on. This measure is order of the department stores to the executives of SYRIZA and will soon lead to a redistribution of sales shares at the expense of traditional markets such as Ermou street, and to the benefit of commercial hubs such as the one nearby airport. Indeed, in the explanatory memorandum, in an impeccable neo-liberal dialect that has evolved into the native language of SYRIZA, it is directly stated that the challenge is to enhance competition… And may the stronger survive!

Another “gift” to certain private interests is also the extension of the purpose of the Claims Management Companies, which is contained in Article 48. The 4th Memorandum gives them the extra opportunity to manage real estate that has been burdened with notices of change or mortgages. This amendment passes houses and commercial roofs that were guarantee in “red loans” to the claws of the predators.

In addition, as facility to the private school owners they offer the opportunity to students participate in classes of foreign languages in private schools.

The imposition of the most primitive liberalism from SYRIZA is further accompanied by the introduction of ‘open access’ of tax authorities in taxpayers data in order to achieve the classification of risk avoidance characteristics (risk profiling) from one hand (ie “big brother state”), and on the other hand the absolute immunity of those who will achieve restructuring or write-offs in order to avoid the risk of persecution (ie “reshuffling of the cards” by people who are above the Law)! Immunity is also given to the members of the Board of Directors of EOPYY (National Agency of Health Services) and other committees, creating in fact a body of state officials – mandarins that operate beyond and above the law.

Article 39 of the new memorandum enables intervention and control by the state on the finances of the political parties. In particular, it states that “the issue of vouchers, the purchase of which is a means of financing, is permitted only if … there is a mandatory mention of the name and VAT or ID number of the buyer, if the amount of funding is more than fifty euros”.

Anti-labour measures

SYRIZA’s promise to restore collective bargaining had the same fate of the … torn Memoranda: “From 21.8.2018, the institutional framework of collective bargaining returns to the status laid down in 1876/1990 (A’27),” as mentioned in the explanatory report.

The measures to mitigate the effects of collective redundancies as advertised by SYRIZA (“amounts for coverage of self-insurance, amounts available through corporate social responsibility for training and consultancy”) are indeed contained in Article 17, with the title “Control of collective redundancies”. But these are measures that “the employer may bring into the attention of the employees”. He may, he may not! As they could do in the past, without SYRIZA’s fourth memorandum.

The opinions of the Supreme Labour Council, are not binding. The Explanatory report of the 4th Memorandum states that “the negative reasoned decision of the SLC due to the non-fulfillment of the relevant conditions is a presumption of nullity of the redundancies before the civil courts,” and nothing more. Meaning it does not have a binding character!

The bad news for collective redundancies are apparent from the very first lines of the explanatory report, which states that the proposed provision takes into consideration “the recent judgment of the EU Court, (Heracles General Cement Company -AGET Heracles- against Ministry of Labor, Social Security And Social Solidarity) C-201/15 of December 21st 2016, which amends the legislative framework for the control of collective redundancies for the purpose of harmonizing national law with EU law”. The decision was interpreted as opening a “window” in order to facilitate the dismissal of 236 workers from the factory of Chalkis, as requested by the French multinational (Lafarge, owner of AGET Heracles), introducing a more flexible interpretation of the Greek law which was clearly much more pro-labour than the European. That is why Lafarge had appealed to the European Court, challenging Greek law.

As far as the lock-out is concerned, what matters is the complaint filed by the Spokesman of the Union of Judges and Prosecutors in the Parliament on May 16th which argues that Article 20 which is contained in Part B (“Work Regulations”) of the Memorandum, brings through the back door the lock-out… which SYRIZA supposedly did not allow to be introduced! Nor the government, or the creditors and their mouthpieces did not breathe a word about this revelation. The retrograde is also confirmed by the amendment of paragraphs 1 and 2 in Article 5 of Law 1264/82, which explicitly and categorically stated that: it is prohibited to recruit strike-breakers and lock-outs are forbidden! These articles were amended. In other words, they ceased to be binding for the employers as it was until May 18th, at least at a typical level.

As regards to the trade union leaves (article 19) they set up a single framework that that uniformly regulates the paid and unpaid leaves.

Ιt is more than obvious that a government that imposes such anti-labour measures cannot be called a leftish government, but the leftovers of a failed capitalism.

Privatizations

In the 4th Memorandum it is provided the disposal “from the date of registration of the statute of the the Public Holding Company to the General Commercial Registry Service, ipso jure and without any compensation, from the State Asset Development Fund (TAIPED), to the Public Holding Company the ownership rights, rights of management and exploitation, acquired financial interests, intangible rights as well as rights of operation, maintenance and exploitation of infrastructure that had been transferred to TAIPED”. Consequently, everything is passed to the Super-fund of sell-out!

In addition, the following twelve legal entities pass immediate to the above mentioned Superfund: OASA (Athens Public Transport Organisation) and its affiliates (OSY SA and STASY SA), OSE SA (Railway Organization), OAKA (Olympic Athletic Center of Athens), ELTA (Hellenic Posts), International Airport, Greek Saltworks, ETVA INDUSTRY CORPORATE COURT, Corinth Canal SA, Central Market And Fisheries Organization, Thessaloniki Central Market, TIF – HELEXPO and Duty Free Shops.

By December 31st, 2017, 66% of DEPA’s (Public Gas Corporation) shares of DESFA’s (Management of National System of Natural Gas) share capital must be sold, through international tender carried out by TAIPED.

JPEG – 57.4 kb

ANA-MPA news. Greece protesters clash with police outside parliament; police fires tear gas

SYRIZA’s temperament in the sell-out of public property is accurately reflected on the table included in the Medium-Term, derived from TAIPED, which shows that in 2017 and 2018 record-breaking collections will occur! Apparently, SYRIZA does not only know to how to “sell-out” the people of the Left, but they also know how to sell-out the public wealth …

The 4th Memorandum also foresees the contraction of DEI (Greek Electricity Board) so that in 2017 its share in the retail market of the interconnected system to be limited at 75.24%, while in 2018 at 62.24% and in 2019 at 49.24%. Moreover, another crushing blow to DEI, will also be brought by the increase of the annual electricity auctioned rates in 2017 at 16%, in 2018 at 19% and in 2019 at 22%. The imposition of the contraction of DEI through administrative way, meaning using the state’s power, shows not only how hollow the liberal anti-state beliefs are, but also that the Government along with the Troika legislate in the name of private interests. Nobody doubts, that behind Article 101 there are certain individuals who are active in the energy market. It is for their sake, that the MPs of SYRIZA and ANEL betray once more the trust of the hard-pressed Greek people!

Countermeasures: sugaring the pill of surpluses

The Government attempted to sweeten the pill of the new memorandum and the bleeding of workers and pensioners by promising a package of measures -the famous countermeasures, which would be applied if and so long as they achieved a surplus of 3.5% of GDP. The countermeasures included reduction in ENFIA (Real Estate Flat Tax) for tax amounts of up to € 700, not exceeding € 70, reduction in the rate of income tax from 22% to 20%, reduction in the special solidarity levy and in corporate tax rate from 29% down to 26%.

The countermeasures also include housing allowance for up to 600,000 households, free health care for a very small proportion of the population with income less than € 1,200, childcare program, school meals, child benefit, work-related measures targeting the registered unemployed of OAED (reek Manpower Employment Organisation), reduction of pharmaceutical expenditures for taxpayers with income up to € 1,200, etc.

The problem is not on that the countermeasures will be implemented after two years. The problem is how a sine qua non for their implementation is the achievement of outrageous fiscal surpluses through the application of the above mentioned measures, as well as any others that may be necessary until the program is completed, in August 2018.

So, the countermeasures, which are tantamount to breadcrumbs and will only be implemented if and insofar the IMF agrees, work like the carrot that legitimizes the whip of reduced pensions and the lower tax-free income level.